Does Applying for Multiple Mortgages Affect Credit?

The journey to homeownership often begins with the search for the perfect mortgage. As potential homebuyers explore their options, questions inevitably arise about the impact of mortgage applications on their credit.

Does applying for multiple mortgages affect credit scores?

Applying for multiple mortgages can impact your credit score, but the influence is typically minimal if you do your rate shopping within a relatively short period of time.

In this article, we answer this question in detail and provide helpful tips for protecting your credit score during the home-buying process.

First, let’s take a look at how mortgage applications work and how credit inquiries are handled.

Understanding Mortgage Applications

When you apply for a mortgage, you request a loan to purchase a home. Mortgage lenders require potential borrowers to fill out detailed applications in order to assess their risk level and eligibility for loans.

This application process typically requires potential borrowers to provide information about their employment, income level, and credit history.

The lender then runs a credit inquiry to access the borrower’s credit report and score.

A single mortgage application can trigger multiple inquiries from various lenders. Each inquiry is reported on the borrower’s credit report and listed in the “hard inquiries” section.

This does not immediately affect your credit score, but it does show potential lenders that you are actively seeking a loan.

How Credit Inquiries Work?

When a lender reviews your credit report prior to approving a mortgage application, this is known as an inquiry.

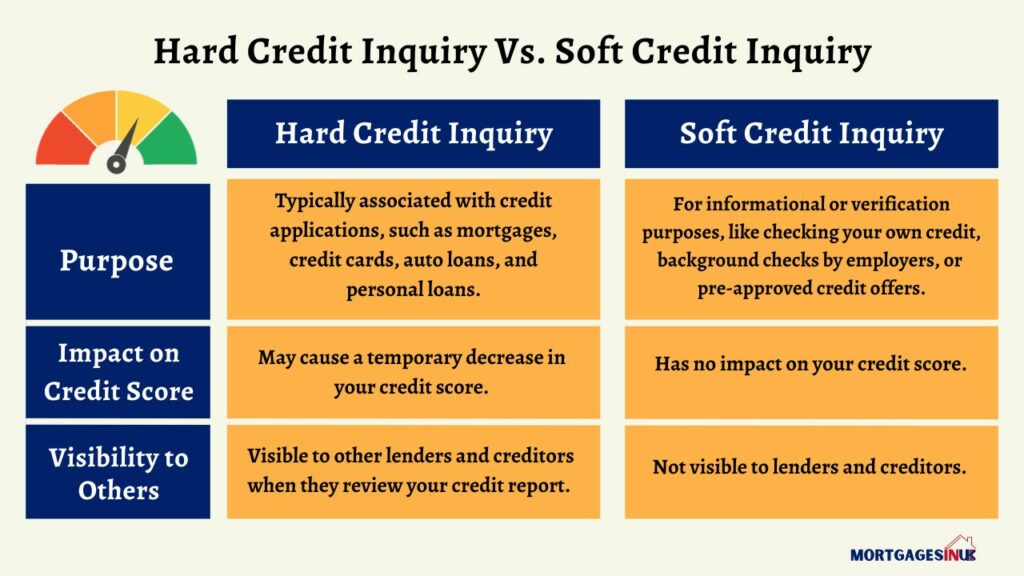

This triggers the lender to review all the information on the report to verify if they want to approve or decline the mortgage. Inquiries can be either “hard” or “soft.”

Hard vs Soft Credit Inquiries

Hard inquiries are when lenders access your credit report for the purposes of approving a loan, and soft inquiries occur when you check your own credit score or potential lenders view your report without taking action.

A hard inquiry has a temporary impact on your credit score, but it’s not a major concern. It does indicate to potential lenders that you are actively searching for a loan, but the effect is usually minimal and typically cleared from your credit report within two years.

Does Applying for Multiple Mortgages Affect Credit?

Applying for multiple mortgages is known as “rate shopping” and it can have an impact on your credit score.

Every hard inquiry listed on your report slightly decreases your credit score. The more mortgage applications you submit in a short period, the greater the potential impact on your credit.

The good news is that most credit scoring models only count multiple inquiries from the same type of loan within a certain period as one inquiry.

This means that if you are looking for multiple mortgages within a period, the credit bureaus will not count each hard inquiry as its own. Instead, they will count all of them as one inquiry when calculating your credit score.

Rate Shopping and Credit Scoring Models

Rate shopping is an essential part of the home-buying process; it allows you to compare different lenders and find the best deal.

However, if you apply for multiple mortgages within a certain period of time, it can have an impact on your credit score.

Credit scoring models recognize that consumers may engage in rate shopping and often treat multiple inquiries for the same type of credit—like a mortgage—as a single inquiry if done within a defined timeframe.

Aim to complete your mortgage applications within a 14-45 day window to ensure your credit is minimally affected when rate shopping.

During this time, multiple inquiries for mortgage loans are typically considered as a single inquiry by credit scoring models.

How to Shop for a Mortgage without Hurting Your Credit?

When you’re in the process of comparing mortgage lenders and loan options, you can minimize the impact on your credit score by following these steps:

Understand the Scoring Model

Before you start shopping for a mortgage, it’s essential to understand how credit scoring models treat multiple credit inquiries within a specific timeframe.

Most scoring models treat multiple inquiries for the same type of credit (like a mortgage) made within a certain window as a single inquiry for scoring purposes.

Set a Timeframe

Plan your mortgage shopping within a relatively short timeframe. Credit scoring models typically consider inquiries for the same type of credit made within a 14 to 45-day window (the exact window can vary depending on the scoring model) as a single inquiry.

Check Your Own Credit Report

Request a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) before you start shopping. This will give you a baseline to understand your creditworthiness.

Research Lenders

Start by researching and identifying potential mortgage lenders. Look at their loan offerings, interest rates, fees, and customer reviews. You can do this online or by contacting lenders directly.

Prequalification vs. Preapproval

Initially, consider getting prequalified with multiple lenders. Prequalification is a preliminary assessment of your creditworthiness and provides an estimate of the mortgage amount you may qualify for. Prequalification typically involves a soft credit check, which doesn’t impact your credit score.

Limit Formal Applications

Once you’ve narrowed down your choices and are ready to proceed with specific lenders, limit your formal mortgage applications to a select few (usually two to three lenders).

Submitting multiple formal applications in a short timeframe can have a minimal impact on your credit score if done within the rate-shopping window.

Coordinate with Lenders

Inform the lenders you’re working with that you are rate shopping and plan to apply with other lenders. This will help ensure they understand your intentions and can provide you with the necessary information for comparison.

Compare Offers

Review the loan offers, including interest rates, terms, closing costs, and other fees. Compare the offers to determine which one best meets your financial goals.

Select the Best Offer

Choose the lender and mortgage option that aligns with your needs and preferences. Notify the chosen lender that you are ready to proceed with the formal mortgage application.

Also Read: Can I Remortgage My House If I Own It?

Monitor Your Credit

Continue to monitor your credit reports during the process to ensure there are no errors or discrepancies. You can also track changes in your credit score.

By following these steps, you can shop for a mortgage without significantly impacting your credit score.

Remember that the impact of credit inquiries on your score is generally small and temporary, and responsible rate shopping is an important part of finding the best mortgage deal.